For those who want to know more about the interest rate on loans of the Community Credit Cooperative

What is the total amount of cash is 800 million won, but how do you need to handle 18 million won??If you need to repay the loan that you need to repay the money related issues that are not more than 7 million won’t meet with money?I think it’s a bit of breath, but I don’t need to see the crisis.If you have a sudden funds, you can take through financial institutions, you can’t get over individual rehabilitation.However, this solution is necessary to learn about lending common sense of lending common sense, so I can help you know about the financial common sense.

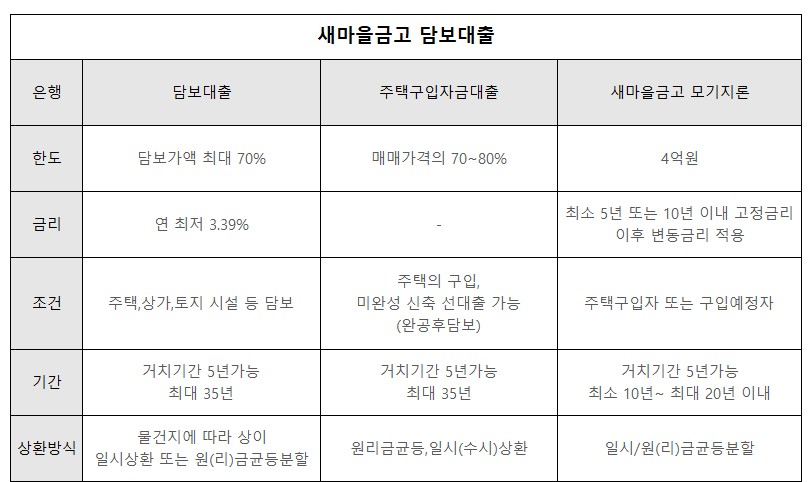

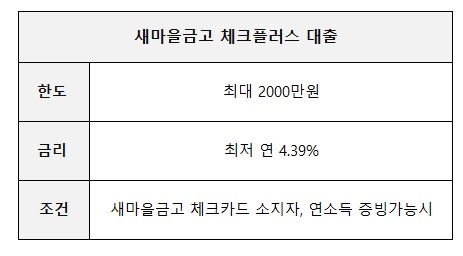

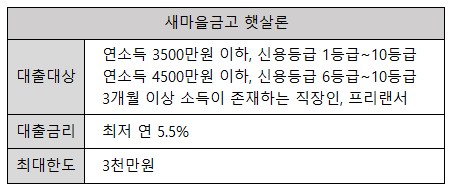

Let me briefly explain the representative news.Let me tell you about the interest rate of Saemaul Geumgo

The difference between primary finance, which refers to general banks, and secondary finance, which includes insurance companies and credit card companies, should not be judged entirely good just because there is a gap in interest rates but low interest rates. Commercial banks can get approval at a 3.16% interest rate, which is much less burdensome, but the limit is not high at 50% of their annual salary, so it is difficult to lend a lot of money. In addition, the results of the screening can be determined by looking at your credit, so you should first select a product considering the purpose of using the loan fund, then decide which one to choose between interest rates and limits, and use financial products.

There is also a loan for the working class that can only be used when the credit score is bad. For those of you who are looking for interest rates on Saemaul Geumgo loans

However, there are state-sponsored products for ordinary people who have difficulty moving funds or have poor repayment ability because they do not have enough cash and creditworthiness, and it is typical to approve them at low interest rates for low-credit people such as workers’ Hessal Loan or New Hope Spore 2 These products can be repaid within three to six years at an interest rate of 7.10% or less, and can be used easily even if the credit rating is bad, so many people use them when the financial status is not good

Let’s talk about loans that can improve profit margins and interest rates on loans at the Korea Federation of Community Credit Cooperatives!

Recently, the growth of the financial technology market has increased due to the constant diversification of financial techniques using small amounts, but in the case of mortgage loans, there is a 60% difference in limit ratio by region such as overheated speculation, adjustment and non-adjustment. However, since the limit of use is measured in the housing market price subject to collateral, the increase in housing prices and interest rate fluctuations should be thoroughly calculated. In addition, there is a way to take out loans and raise about 10 million won to join the stock market to make profits exceeding 3.5% interest rates, but depending on market conditions, there is a risk rate, so it should be thoroughly compared and used efficiently.

If you are familiar with it, it will be easier to use when you need funds.For those of you who are interested in the Saemaul Geumgo Loan Rate

Whether it’s to receive living expenses or raise funds necessary for financial technology or investment, in order to start in a good position in the current society, you have to be aware of the trend of the economy moving in advance. In addition, as uncertain information collection and ambiguous decisions will soon lead to significant damage, it should be used smartly only after being careful. You can take out loans without spending your own money and pay them back by making income with financial techniques, or you can jump into the real estate market in overheated speculation zones without having to spend a lot of money if you only know the core of the loan. Just as there is a financial difference between being approved at a 5.5% interest rate even for loans of the same name and paying back more than 15%, the point is to lower the risk and use good loan products wisely under individual conditions.

Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image

![[애니] 로봇 드림 │ Robot Dreams 2023 [애니] 로봇 드림 │ Robot Dreams 2023](https://rain.mbcs.kr/wp-content/plugins/contextual-related-posts/default.png)